This morning, I had an appointment with a couple in Erlanger, KY. They had come across our website and called our number because they want to sell their house.

It’s a cute 2 bedroom, 1 bathroom house close to 1-275.

As a family, they’ve simply run out of space, and the gentleman told me he would really like to move somewhere in the country where he has a little more room and less neighbors around.

As is generally the case with houses we see, this house was a bit run down. There were no real terrible problems that would cause a major repair. However, all of the little items that are not kept up with over the course of 15 years or so add up. It needed a new kitchen, a new bathroom, lots of patching and painting, new flooring. It could use some work on the exterior in terms of the roof, porch and maybe adding a deck.

Basically, it’s a typical house that has seen 15 years of living without many improvements at all.

Considerations For Our Fair Cash Offers

So, how do we come to our fair cash offers on houses?

The first thing we do is look at the comparable properties in your neighborhood. We need to look at homes with the same amount of beds and bath, similar square footage, etc. that have sold within the last 6-12 months to get a good idea of what your home will sell for once it has been rehabbed.

Then, we start subtracting out the costs it takes to get there.

Rehab, Closing, Holding Costs & Profits

The first costs are the rehab costs itself. Things like paint, carpet, drywall, cabinets and new fixtures all have hard costs to them. Plus, you need to pay for the contractors and potentially a general contractor to manage the project. Even with something simple like a cosmetic renovation, you’re still probably looking at $25-$30,000 in expenses.

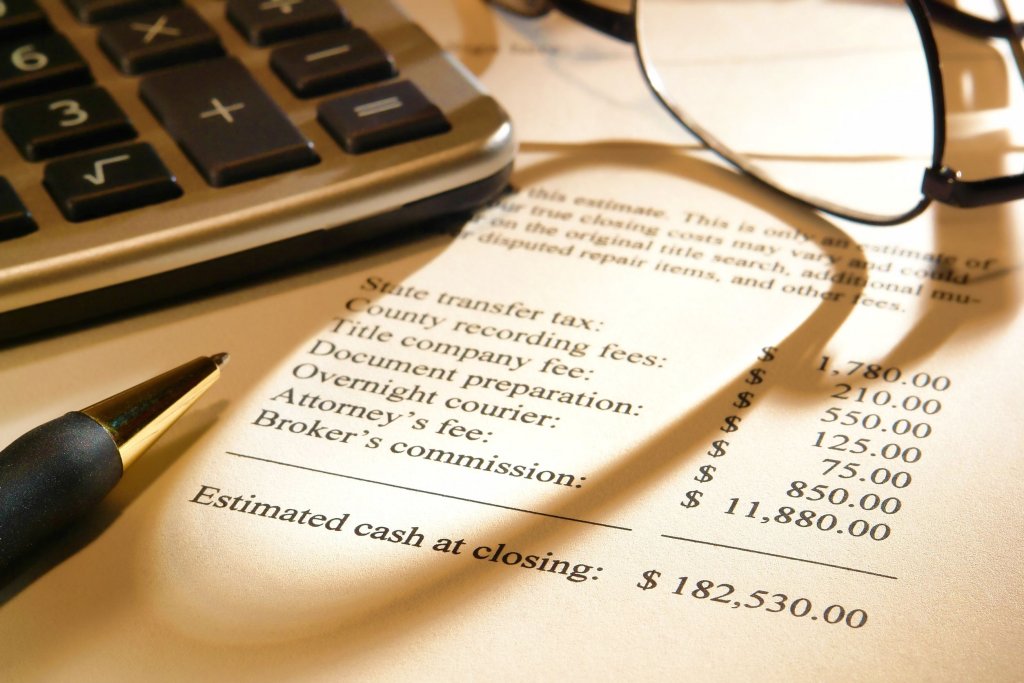

The next expense that you need to consider is the selling costs. In many situations when we buy homes, our company is paying for all of the closing costs. There are costs to performing a title search. There are costs to having the property inspected. Here are other closings costs to consider:

- Attorney’s or escrow fees (yours and your lender’s if applicable)

- Property taxes (to cover tax period to date)

- Interest (paid from date of closing to 30 days before first monthly payment)

- Loan origination fee (covers lender’s administrative costs)

- Recording fees

- Survey fee

- First premium of mortgage insurance (if applicable)

- Title insurance (yours and your lender’s)

- Loan discount points

- First payment to escrow account for future real estate taxes and insurance

- Paid receipt for homeowner’s insurance policy (and fire and flood insurance if applicable)

- Any documentation preparation fees

Once you add up all of these expenses, closing costs can easily be $3-4,000.

Next, you have holding costs. These are the costs associated with holding the property until it is resold and include insurance, utilities, interest on investor’s money, etc. Again, these can rack up fast and be another $5,000.

Now, you are already up to around $40,000 in costs to buy and rehab your home, but there has been no profit baked in for our company and the house flipper. See how much goes into our fair cash offers?

With our company, we tend to want to give our investors and partners the majority of the profit. So, we need to bake in probably another $20,000 at least that will be enough profit margin for a rehabber to want to take on the risk of buying, rehabbing and selling the property.

Don’t forget, because we pay all cash, you don’t have to pay real estate agent commissions, but that doesn’t mean that our investors don’t have to pay those fees when they sell the rehabbed home to an end user. Those costs need to be considered as well.

At the end of the day, we need to factor all of these numbers into the equation to come up with a number that will make sense for you, the seller. We know you may need to pay off the mortgage and have some cash on hand for your next living situation.

And at the same time, the numbers need to make sense for us to buy your home, do the necessary repairs, sell to a new buyer and make some profit for our efforts.

The offer you receive may be less than what you think your home is worth. However, as we’ve run through the different expenses, you now have a better idea of the costs and risks associated when we buy a house from you and make our fair cash offers.

When we buy a house from you, we are VERY OK with walking you through the numbers. We’ll show you the comparable homes if you want and run the math on our expenses. If you are talking to other cash buyers, and they are throwing out an offer to you and don’t want to tell you how they came up with it, be very careful.

We are a locally owned family business in Northern Kentucky. We grew up here, and we care deeply about our community and the residents. If you are in a hard situation and need to sell your house fast, we want to help you. But, we will only do it in a manner of utmost respect, integrity and character.